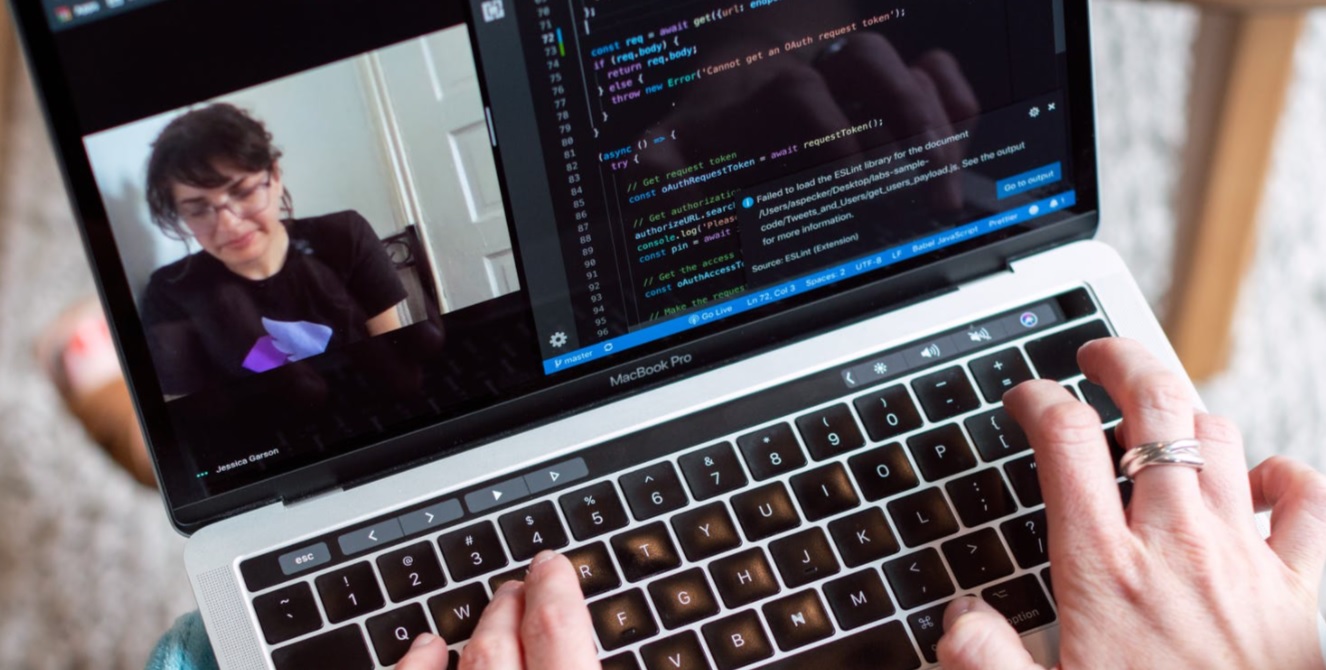

In this increasingly digital age, more and more in the world of finance is happening online. One of the more recent must-haves of financial technology is virtual data rooms.

Investment bankers use data rooms to securely store and share sensitive documents and information for a variety of transactions and projects, especially mergers and acquisitions. They help teams stay organized and speed up the due diligence process that could previously take weeks to accomplish in person.

Read on to learn how to get the most out of these wildly popular new tools of the finance world.

1. Choose the Right Provider

Virtual Data Rooms, or VDRs, and their providers come with a wide variety of security features, organization and search tools, and price points. You’ll want to make sure whatever provider you choose offers the following essentials:

- Customizable folder and document permissions

- Document expiration functionalities

- Watermarking

- Activity monitoring

- Project archiving

On top of these basic features, some providers will offer reporting and analytics, bulk upload and download options, and a question and answer module. Some VDR providers also specialize in certain types of usage, like real estate or mergers and acquisitions. Be sure to do your research and find the provider that best fits your needs, budget, and size as a company.

2. Prepare Your Documents Early

No VDR can save you if you’ve waited until the last minute to scan all your important documents from hard copy to digital, so start gathering those early! The type of documents you’ll be requested to provide will of course vary, but in most finance due diligence processes, you’ll be asked to provide founding documents, leases, employee contracts, and any NDAs on file.

3. Assign Roles and Access

Setting up your VDR is no small undertaking and will likely require input from many different departments, depending on the size of your business.

It’s a good idea to have one main point person to oversee the data room. This way, there will be consistency and accountability across the project, especially when it comes to organizing and naming files and documents, which we’ll get to later.

It may even be worth making the VDR set up a full-time priority for one employee for the duration of an important merger or acquisition.

4. Organize the Documents

Intuitive, simple file naming and storage is essential to ensure your documents are easy to access. It saves time and ensures everyone has access to what they need. And remember to try to take on an outsider’s perspective when it comes to your naming process. Those acronyms and abbreviated names you’ve grown familiar with around the office are likely to perplex the people you’re sharing your documents with.

You’ll also want to ensure your file naming allows for easy searching. This means staying consistent in your naming (if you decide that acronym is well-known enough to be recognized, be sure you’re using it every time rather than spelling out the full title). It’s also best to avoid underscores or special characters.

5. Triple Check Your Settings

Once everything is uploaded and permissions are set, it’s important to do a thorough check that everything is correct before you start inviting people to view. You want to be sure only the intended parties are able to view particular folders and files — and that documents can’t be copied or exported out of the VDR without permission.

Conclusion

Virtual Data Rooms are must-haves in the world of finance but are also used in fundraising, audits, intellectual property management, and almost anything else you can think of that involves sharing sensitive documents. Don’t get left in the Stone Age or risk a security breach, and invest in a top-notch VDR provider for your company today.

Leave a Reply